I hope you all are doing great in your career and life. Many times

people wish to have a secure future and are willing to save and invest for it,

but lacks direction.

Where to start, what to do, how to invest are the questions which

remains unanswered and hence they fail to begin early.

By this article I would like to highlight my financial plan, so that

people might get an idea of where to start and set priorities to have a

financial plan.

This financial plan would be most relevant for persons fulfilling

following criteria:-

1. Age – 28 Years.

2. Income – Rs.1.25 lac per month after tax.

3. Not sole earning member in family.

4. Have exposure in mutual funds and Equity.

So let's get started

I have divided the financial plan in 3 categories which will act as a

checklist for persons who have not yet started their financial planning.

1. Health insurance.

2. Life insurance.

3. Investments.

1. Health insurance

70% of Indians are just 1 medical bill away from poverty. This statement

has a serious gravity only if one understands it well.

Needless to say, health insurance is the need of the hour, and since we

have seen the deadly covid -19 pandemic just 2 years before, everyone must have

encountered with at least one situation in their close circle if not more,

where the person in need borrows money for paying the bills of hospital. (Mortgage

of gold, house is quiet common in these situations)

So why should one indulge into such situations, if he can pay a small

premium per anum to get insured against this fearful situation.

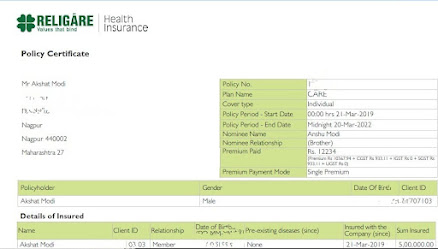

I had bought my health insurance policy from Care Health Insurance in March 2019 for 3 years at once for Rs 12,234/-.

Later in March 2022 got it renewed again for 3 years till March 2025 by paying premium worth Rs 20,943/-.

Paying premium for 3 years at once allowed me to save 10% extra as

companies offers these discounts for bulk payment. An added advantage is that I

am spared from paying increased premiums for next two years as companies has

increased premiums by 10-15% in 2022.

What does my policy covers?

Sum insured - 5 lacs

No claim bonus - 150%

Room rent - no capping single private ac room

Free annual health checkup (costing approx 2000)

Health insurance companies have a waiting period of 2 to 4 years for preexisting

diseases(PED).

Meaning if a person is already taking medication of heart related

diseases, his claim for heart attack

will not be settled by company if it's in waiting period.

One can reduce the waiting period by paying some extra premium. So what one should do to get hassle free claims?

Buy health insurance today AND disclose all existing diseases, pay some extra premium but have a peaceful sleep at night.

What is no claim bonus?

Since I have not claimed any claims from the company in these years, company offers me enhanced sum insured of 12,50,000(150% of 5,00,000) instead of 5,00,000 for future.

So I am insured to the tune of 12,50,000 but paid premium for 5,00,000

only. This is an added advantage for being loyal to the company.

Medical inflation is approx 15% p.a in India and is expected to grow at

this rate for next 5 years.

By buying this health insurance policy, me and my family is financially

secured from any unforeseen emergencies of hefty medical bills.

2. Life insurance

Death and taxes are the only things certain in life.

Why should one buy life insurance?

When you are alive, your family is dependent on you for financial needs,

but in case of death especially at an early age, family is shattered not only

emotionally but financially as well.

Having a life insurance policy helps your family to cope up with this

financial crisis and maintain same lifestyle expenses while you were alive even

after your death upto a certain years till the age when children completes

education and are mature enough to earn by themselves.

Having a term plan can

significantly help in dealing effectively with such situations.

If a family's yearly lifestyle expenses is 6,00,000, then a term plan of

1 crore can serve the family for next 15 years considering inflation and if

properly invested can serve for more than 15 years also.

I have purchased a term plan worth Rs 1 crore from Bajaj Allianz Life Insurance company. The details of the plan are as follows:-

Outflow – Rs 23,156.32/- p.a

Tenure – 20 years (Premium paying term)

Total Outflow – Rs 4,63,125/- in 20 years

Insured upto age 85 years.

(If I die before 85 years, my family will get Rs 1 crore)

Policy term – 58 years (85 -27)

27 was my age at the time of buying the term plan.

One may choose a shorter policy term of 48 years, where in he will be

insured till the age of 75 years.(premium will be slightly less).

3. Investments

I have started investing 20000 per month in ULIP, which can be termed as tax free mutual funds along with insurance benefits.My goal is to make my 1st 1 crore Rs and investing Rs 20000 per month for next 15 years would help me acheive that goal.

SUMMARY :-

2. Have adequate Life insurance cover as a backup for your family’s financial needs, when you are gone. I have bought a term plan at age 27 for Rs 1 crore by paying annual premium of Rs 23156 fixed for next 20 years and insured till the age of 85.

3. Make a goal and alight your investment to acheive that goal. To acheive long term wealth creation one should invest in equity linked products. Start investing early if possible from today. Start with 20k per month, if that's too much go with 15k or even 10k. But start investing you will be amazed to see the benefits of compounding in the long run.

As and when the income increases, one should again reassess the financial needs and plan again for further investing in asset class which best suits you at that particular time.

Further Consulting a financial advisor is highly recommended.

If you need any help regarding financial Planning or have any suggestions feel free to contact us at 9028912025 or email @ caakshatmodi@gmail.com.

#financialplanning#early retirement

Disclaimer :- This material has been prepared for

informational purposes only, and is not intended to provide, and should not be

relied on for, tax, legal or financial advice. You should consult your own tax,

legal and financial advisors before engaging in any transaction.

.jpeg)

.jpg)

.jpg)

No comments:

Post a Comment