Recently one of my friend

sold a plot for Rs. 49,00,000/- in March 2022. Can you guess the purchase

amount paid by his Grandfather?

It’s unreal!!

only Rs. 1200 in the year 1985. So the

amount has multiplied by 4000 times over the period of 37 years and in CAGR (Compound

Annual Growth Rate) terms it has given an annual return of 25.20%.

Having made some

extraordinary gains, he came to me for filing income tax return and asked the

most common question, how to save income tax on these massive gains.

So here is what I

advised him:-

1. Since

plot is not a residential house property, the option to claim exemption under

section 54 is not available.

2. So

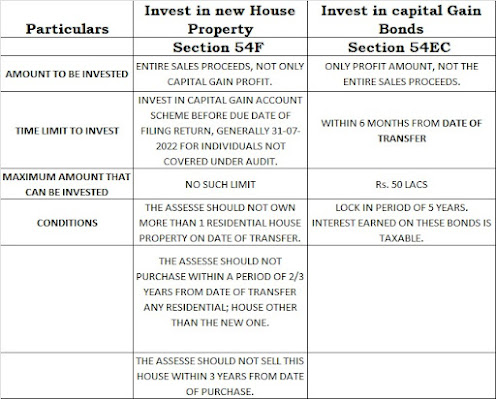

in order to save taxes and claim exemption he has 2 options:

a.

Section

54EC

: Invest in Capital Gain Bonds.

b. Section 54F : Invest in new House Property.

3. There

are certain conditions and restrictions in both sections and is dealt below separately:-

4. Section 54EC :

a. Amount to be invested:-

Amount of Capital Gain to be invested(Profits) and not the entire sales

proceeds.

b. Time limit:- Within

Six months from date of transfer.

c. Maximum Limit:-

A maximum of Rs.50 Lacs can be invested in any financial year.

d. Lock in Period:- There

is lock in period of 5 years, meaning you cannot sell the bonds before 5 years

from the date of acquisition.( if sold before 5 years then capital gain

exemption claimed in earlier year shall be taxable in the year of transfer)

5. Section 54F :

a. Amount to be invested:-

Amount of entire sales proceeds to be invested and not only the Capital Gain

(Profits).

b. Time limit:- Purchase 1 new residential house within 2 year

from the date of transfer or

construct 1 new residential house within 3 year from the date of transfer.

(Since it’s difficult to find the

right house property, one can deposit the net sales consideration in Capital Gains Account Scheme before due

date of filing return for relevant assessment year until he finds the suitable

house property. The deposit in this account shows the intention of individual

that he will buy the residential property within prescribed time limit. Just

because the desired property is not yet available for purchase this deposit is

being made, the exemption u/s 54F is claimed by depositing the sum in Capital Gains Account Scheme.)

c. Maximum Limit:- There

is no maximum limit on amount that can be invested.

MOST CRITICAL ASPECT

THAT YOU MIGHT MISS

What Happens

if the Amount is not deposited in capital Gain Account Scheme within due date

i.e. section 139(1)?

·

Subsection (4) of section 54F plays

the most critical role here. It is specifically mentioned to deposit the amount

of the net consideration which is not appropriated by the assesse towards

the purchase of the new residential house property in capital gain account

scheme before due date of return under section 139(1).

·

If an individual fails to deposit the

amount within due date, he is left with only two option:-

1. To

purchase the new residential house property within the due date of filing

return i.e. 139(4) since the due date u/s 139(1) has already elapsed. The due

date of filing return U/s 139(4) is 31-12-2022.

2. To

pay the capital gain tax @ 20 % on the profits earned.

·

The time period which was allowed i.e.

2 year /3 year for purchase / construction shall stand withdrawn, because the

assesse fails to deposit the amount in Capital Gain Account scheme before due date.

·

A major problem which an individual may

face is when he deposits the amount after due date and consider this as due

compliance under income tax act. Once the due date is over even a single day delay

attracts altogether different provisions under the income tax act.

·

It is advisable to consult a good tax

consultant before making any decision that impacts your taxes.

“Beware

of False knowledge, it is more dangerous than ignorance”

A tabular comparison

of different option under section 54F is presented below for your reference:-

|

Section 54F |

||

|

Invest in new House Property |

||

|

|

option 1 |

option 2 |

|

Particulars |

Purchase/ construct directly 1 residential house

property |

Deposit in capital gain Account scheme and

further purchase residential house property. |

|

Property

sold in financial year |

2021-22 |

2021-22 |

|

Due date

of return filing(Belated and original) |

31-12-2022 |

31-07-2022 |

|

Section |

139(4) |

139(1) |

|

Time

Limit to Purchase House property |

Before due date of filing return of income i.e.

31-12-2022. |

Amount deposited in CGAS before 31-07-2022,

hence extended time of 2 years for purchase and 3 years for construction from

date of transfer is available. |

Disclaimer

:- This material has been prepared for informational purposes only, and is not

intended to provide, and should not be relied on for, tax, legal or accounting

advice. You should consult your own tax, legal and accounting advisors before

engaging in any transaction.

Study

Material:

1. ITO vs. Smt. Rosamma Korah [2014] 45 taxmann.com 153 (Cochin –

Trib.)

2. CIT vs VR Desai (2011) 197 Taxman 52 (Ker).

For any suggestion or queries you can reach out to me at caakshatmodi@gmail.com or at 9028912025.

You can follow me on other social media handles from below links :-

https://www.linkedin.com/in/akshat-modi-2ba297a0

https://www.facebook.com/akshat.modi.372

https://www.instagram.com/akshat3636

https://twitter.com/ModiAkshat?t=k5aO4-AqiuUKUXfnu4Fsdg&s=08

https://t.me/fcaakshatmodi

https://g.page/r/Caz8pLU7ya9SEA0

.jpeg)

.jpg)

.jpg)

2 comments:

Very Informative

Thanks for sharing about how to save income tax. Filing tax returns is a yearly action that is regarded as a moral and social obligation of all responsible citizens of the country. You can also check out about Income Tax Filing here.

Post a Comment