Gone are the days when people use to retire at 60, with a limited

corpus. This young generation wants financial freedom at young age. The life of our earlier generations was full of responsibilities. Sacrificing

self-desires for betterment of family.

We can broadly classify the lifestyle of Previous 3 generations after

independence as follows-

1947-1977

Majority people of this generation suffered extreme poverty. Their only

desires were the basic necessities Roti-Kapda-Makan. Some of the people were privileged enough to get higher education and a

decent paying job.

But majority people were left

with no proper working conditions, Sethji employers, minimum salaries,

no holidays, exploitation, low self-esteem and what not..

This generation learned the lesson of Hard work and Value of money the

hard way.

Disagreeing with employer or saying no for a particular work was never

thought of by employees back then.(family responsibilities)

1978-1997

People of this generation were provided with basic mandatory education. Globalization and liberalization opened gates for both business and

education to a great extent.

With sheer dedication and hard work, people excelled in their life. Big

business, industrialization, IT reforms etc. left no stone unturned for growth

story of India. People now have the basic necessities but didn't have the luxuries.Again family responsibilities, building a house, providing good education

for children, savings for emergencies were the top priorities.Maintaining good relationship with employer for career growth was

mandatory, switching jobs was not easy, disregarding employer still not very

common.(job security, career stability, family responsibilities)

Planning for retirement for self desires was still not the cup of tea for most of the people.

1998-2022

Majority people of this generation has the basic necessity and a

privilege of sound education. Access to low cost internet facility, financial education, paved the way

for a civilized society. Startup culture, desire to earn more money, fame, luxury is the latest

trend. People nowadays want a healthy work environment, work life balance,

handsome salaries, growth and mental peace above all.Bullshit of employers are no longer tolerated, job switches are

comparatively easy.

Up skilling with latest technologies, good communication skills and

networking are the new age necessities.

To cut the long story short, people nowadays are smart enough to earn

for the necessities and work for luxuries.(financially sound and independent)

This generation works and save for self desires, vacations along with

family responsibilities. This young generations’ plan of retirement is also quite different.

Let’s understand this in following manner:-

Mr Saurabh's age is 30 and is earning 1 lac a month.

He has two options to plan his retirement.

1. Save 10000 per month and invest in equity market based products for

next 30 years and have a corpus of Rs 3 crore at the age of 60.(assuming 12%

return per anum)

Or

2.Save 20000 per month and invest in equity market based products for

next 15 years and have a corpus of Rs 1 crore at the age of 45.(assuming 12%

return per anum)

Let me know in the comments which option will you choose?

Both the options are good, and one can choose according to his comfort.

But majority of the younger generation is inclined towards option 2.

Having a corpus of 1 crore at age 45 means you can withdraw 1 lac per

month and keep the corpus intact and growing.

If you can sustain on 50,000 per month today, you can meet your basic

livelihood with 1 lac a month after 15 years, considering inflation rate of 5%

p.a.

Here Focus is not to retire at age 45 and sit back at home and relax, but to have financial freedom, ownership of time, pursuing your hobby,

making your hobby your active source of

income (latest trend), living a meaningful and content life, spending

quality time with family and list is never ending.

Basically “Do

what makes you happy”

So what's the point I am trying to make here.

By the passage of time salaries increment, career growth and switches

are bound to happen. One should not hesitate to start a sip of 15000 to 20000 if you are earning 1

lac per month.

You need to start investing early

and also a handsome amount(15-20% of your

salary) in order to retire early and have a financial freedom.

A proper financial plan and goal based investing is the key for happy

retirement and mental peace.

One should have a provision of emergency funds of at least a 6 months’

income. Provision for vacation, education is always recommended.

Summarizing the topic What, When and How of financial freedom and early retirement:-

What-Relying upon

passive income after a certain age for basic necessities, rather than actively

working for the same is the essence of any effective financial retirement plan.

When- Investing

from an early age of 25- 30 years is the best time to start investing for

retirement.

If you missed the bus, start today.

The best day to start your retirement planning is

first day of your career, the next best day is "TODAY".

How- Build a

balanced portfolio, have exposure to equity market, Reits, gold, guaranteed

investment products, insurance. Focus on inflation adjusted, tax adjusted

returns and cashflows rather than per anum returns in % terms.

“Give time to your investments, rather than timing

your investments.”

Food for Thought:-

Equities today may be ok if one is starting a small SIP but may not be

ok if one has a large Lumpsum to invest.

Equities may be ok for a young person but may not be ok for an elderly person.

Debt may not serve its purpose for a poor man but may be perfect for a

rich man

A Financial Strategy is like making tailor made clothes which fit you

perfectly well.Quality of fabric is content but if it does not fit you then it serves

no purpose because it is out of context.

Therefore when it comes to your Investment never compare your strategy

with that of others because your context and theirs are different.

What is a good investment' has no answer without understanding the

context.

The role of an Advisor is to provide decent returns for his clients

but the most important role is to manage and mitigate risks involved in investing.

Don't be in a rush to choose the investment product giving maximum returns, but have a balanced exposure based on your risk appetite and mitigate your risk.

Consulting a financial advisor is highly recommended.

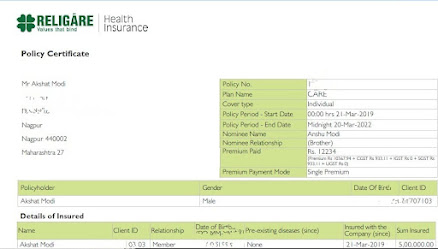

If you need any help regarding financial Planning or have any

suggestions feel free to contact us at

9028912025 or email @ caakshatmodi@gmail.com.

#retirement#retirementplanning#investment#financialplanning#early

retirement

Disclaimer :- This material has been prepared for

informational purposes only, and is not intended to provide, and should not be

relied on for, tax, legal or financial advice. You should consult your own tax,

legal and financial advisors before engaging in any transaction.

.jpeg)

.jpg)

.jpg)