Hello everyone

There was always a lot of confusion about applicability

of income tax audit for certain class of person, those people who declare

profit less than 6/8% of their turnover (6% in case of turnover done through

banking channel and 8% in case of turnover done in cash mode) or in case of

person declaring losses.

Currently also there is a lot of buzz about the same

topic and this prevails in every tax audit season.

By this article I will try to unfold all the relevant

provisions and hope by the end of this article everyone gets a bit more clarity

relating to section 44AB/44AD .

I will draft this article in QNA pattern so that

maximum doubts can be covered and that too in easy to understand language. In

the end of the article will be sharing extremely easy flowchart to find out

applicability of audit, so stay tuned and read till last.

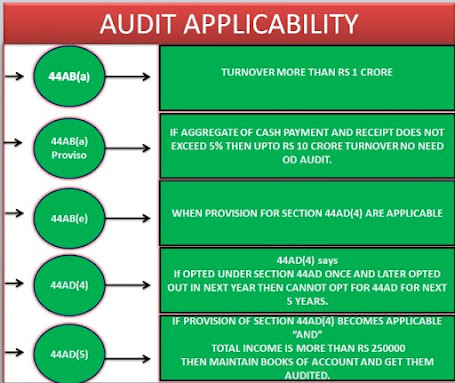

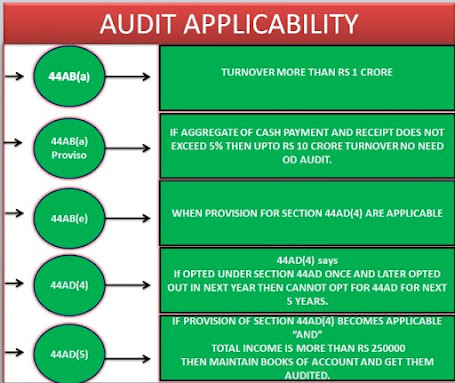

Also for businesses having turnover above Rs 1 crore, there is not much

ambiguity regarding applicability of audit. An analysis of cash transactions

both receipt and payment would help in determining applicability of Tax audit.

If cash transactions are less than 5% of total receipt AND payment, than even

if your turnover is more than Rs 1 crore but upto Rs 10 crore tax audit is not

required.(Applicable from assessment year 2021-2022)

So here goes the questions for businesses having turnover below Rs

1 crore :-

1.My turnover

is less than Rs1 crore and Profit is less than Rs 2.5 lacs but Total income is more than Rs 2.5 lacs whether I

need to get my books of account audited?

Ø The audit limit

under section 44AB (a) of Rs 1 crore is not crossed, hence under section 44AB(a)

audit is not applicable.

Now check whether in previous year you have opted to

file return under section 44AD (irrespective of turnover).

If not opted for section 44AD, books of account

maintained, income tax return filed with proper balance sheet and profit and

loss account then no need for audit, prepare balance sheet and profit and loss

account of current year and file return.

But if opted for section 44AD in previous year and

this time opting out i.e. not showing 6/8% profit of the turnover then, you

cannot opt for section 44AD for 5 successive year.(section 44AD(4)).

Now Section 44AD(5) comes into play which says, if Section

44AD(4) is applicable

“AND”

Total income is

more than Rs 2.5 Lacs then you have to maintain books of account and get them

audited.

In this case although profit is less than Rs 2.5 Lacs

but Total income is more than Rs 2.5 Lacs audit under section 44AB(e) is

applicable.

2. My Turnover

is less than Rs 1 crore and Loss is Rs 5

lacs and I do not have any other income whether i need to get my books of

account audited?

Ø The audit limit under section 44AB (a) of Rs 1 crore

is not crossed, hence under section

44AB(a) audit is not applicable.

Now check whether in previous year you have opted to

file return under section 44AD (irrespective of turnover).

If not opted for section 44AD, books of account

maintained, income tax return filed with proper balance sheet and profit and

loss account then no need for audit, prepare balance sheet and profit and loss

account of current year and file return.

But if opted for section 44AD in previous year and

this time opting out i.e. not showing 6/8% profit of the turnover then, you

cannot opt for section 44AD for 5 successive year.(section 44AD(4)).

Now Section 44AD(5) comes into play which says, if

Section 44AD(4) is applicable

“AND”

Total income is more than Rs 2.5 Lacs then you have to

maintain books of account and get them audited.

In this case since there is loss of Rs 5 Lacs so Total

income is less than Rs 2.5 Lacs, hence audit under section 44AB(e) is not applicable.

3.My turnover

is Rs 99 lacs all through banking

channel and profit is 4 lacs whether i need to get my books of account

audited?(since profit is less than 6%) I had opted for section 44AD in previous

year.

Ø The audit limit

under section 44AB (a) of Rs 1 crore is not crossed, hence under section 44AB(a) audit is not applicable.

Now check whether in previous year you have opted to

file return under section 44AD (irrespective of turnover).

Yes opted 44AD in previous year and this time opting

out i.e. not showing 6/8% profit of the turnover then, you cannot opt for

section 44AD for 5 successive year.(section 44AD(4)).

Now Section 44AD(5) comes into play which says, if

Section 44AD(4) is applicable

“AND”

Total income is more than Rs 2.5 Lacs then you have to

maintain books of account and get them audited.

In this case since Total income is more than Rs 2.5

Lacs audit under section 44AB(e) is applicable.

The legislative intent behind this section, may be to

act as deterrent for the assessee from misusing the provisions of presumptive

taxation by frequently shifting from presumptive taxation to non-presumptive

taxation and vice-versa.

Lets understand the legislative intent behind this

clause by an example:-

In previous year Mr. Gupta had a business turnover of

Rs. 90 lacs all through banking channel. He opted for section 44AD in that year and declared profit

@ 6% of turnover which comes to Rs 5,40,000/-. After claiming the deductions

under section 80C of Rs 50,000/-, his total income comes out to be Rs.

4,90,000/-. He does not have any other deduction under the income tax act. Thus

after claiming rebate under section 87A(since Total income does not exceed Rs

5,00,000/- eligible for rebate), his tax

liability was nil.

He has opted to file under old tax regime and not

under section 115BAC.

Now in current year on Rs. 99 lacs turnover all

through banking channel his

Net Profit (6% of Rs 99 lacs) is Rs 5,94,000/-

Gross Total income is Rs 5,94,000/-

Section 80 C deduction Rs 50,000/-

Total income is Rs 5,44,000/-

Income tax on above income is Rs 22,152/-

5% on Rs

2,50,000/- i.e. Rs 12,500/-

20% on Rs 44,000/- i.e. Rs 8,800/-

Total tax Rs 21,300/-

4% Cess on Rs 21,300/-i.e. Rs 852/-

Total tax including cess Rs

22,152/-

Now with an intention to evade tax worth Rs 22,152, Mr

gupta wants to file return of income with balance sheet and profit and loss

account so as to claim some dummy expenses worth Rs 45,000/- and ultimately

reducing total income to Rs 4,99,000/- i.e below Rs 5,00,000/-. This will make

him eligible for rebate under section 87A and thus in current year also his tax

liability will be nil.

In order to curb these illegitimate switches between

section 44AD and normal return filing with financial statements the government

has enacted section 44AD(4) and 44AD(5).

4. I am opting

for section 44AD since last 5 years, my turnover in previous financial year crossed Rs 2 crore so I got my

books of account audited for that year. Now in current financial year my

turnover is only Rs 1.90 crore, do I need to get my books of account audit for

this year or I can opt for filing under section 44AD?

Ø As per section 44AD(4) if a person opts for section 44AD

in previous year and this time opting out i.e. not showing 6/8% profit of the

turnover then, you cannot opt for section 44AD for 5 successive year.

In previous financial

year, you were mandatorily required to get books of account audited since

turnover crossed Rs 2 crore and you do not have the option to opt for section

44 AD for return filing. Since you have not opted out voluntarily for

illegitimate tax evasion but to comply with the law you can opt for section

44AD in current financial year and audit is not compulsory.

FEW IMPORTANT POINTS :-

1. Only Individuals, Huf And Partnership Firm excluding LLP Can Opt For Section 44AD.

2. A Person earning Commision Income Cannot Opt For Section 44AD.

3.A Person Can Opt For Section 44AD Only If Turnover Does Not Cross Rs 2 Crore In A Year.

Attaching herewith pdf of FAQ issued by income tax department which covers various queries relating to this topic.

https://www.incometaxindia.gov.in/Tutorials/13.%20Tax%20on%20presumptive%20basis%20in%20case%20of%20certain%20eligible%20businesses.pdf

Enjoy Reading!!!

For any suggestion or queries you can reach out to me at caakshatmodi@gmail.com or at 9028912025.

You can follow me on other social media handles from below links :-

https://www.linkedin.com/in/akshat-modi-2ba297a0

https://www.facebook.com/akshat.modi.372

https://www.instagram.com/akshat3636

https://twitter.com/ModiAkshat?t=k5aO4-AqiuUKUXfnu4Fsdg&s=08

https://t.me/fcaakshatmodi

https://g.page/r/Caz8pLU7ya9SEA0

Disclaimer :- This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

.jpg)

.jpg)

.jpeg)

.jpg)

.jpg)